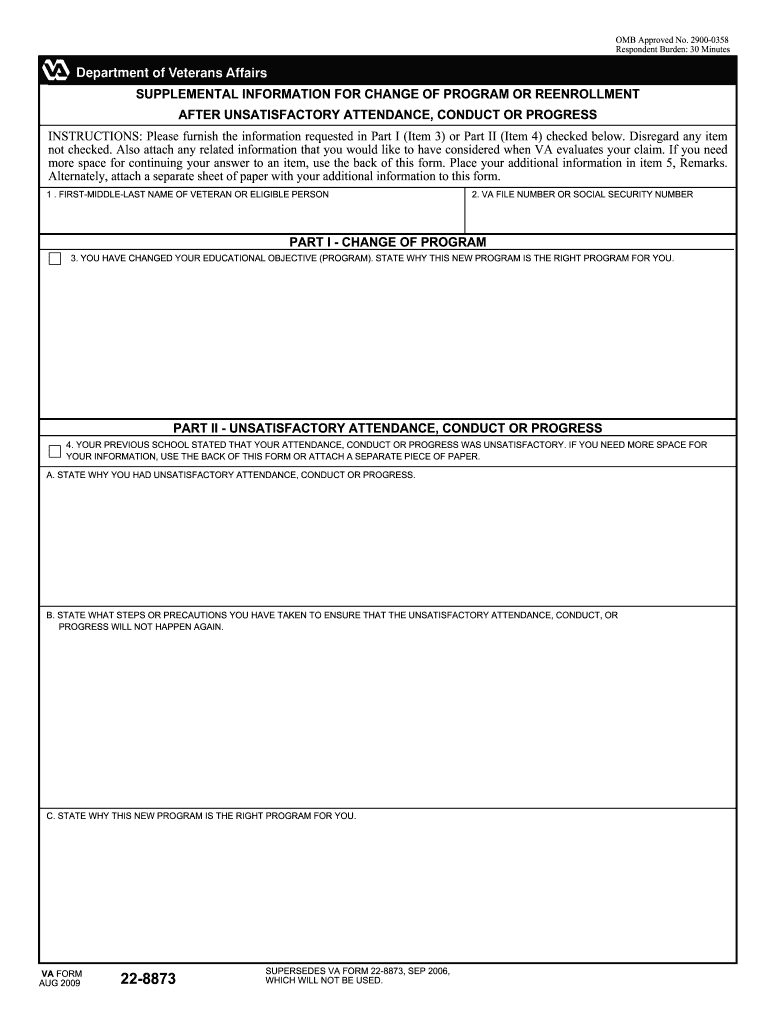

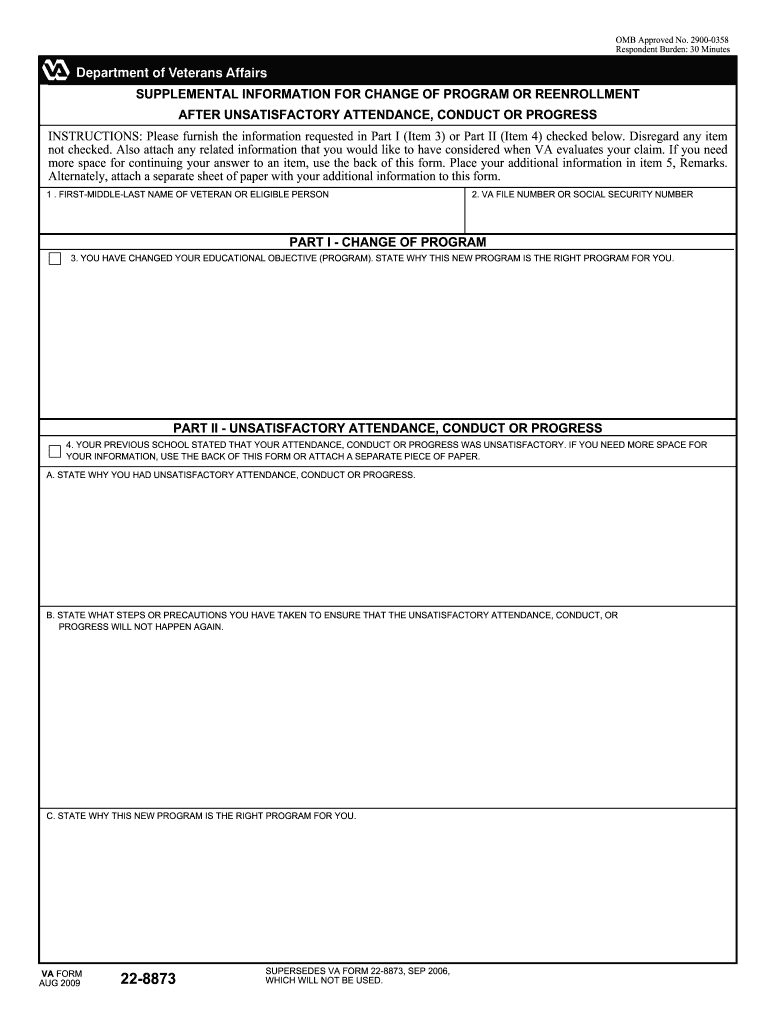

VA 22-8873 2009-2024 free printable template

Get, Create, Make and Sign

Editing va you conduct make online

VA 22-8873 Form Versions

How to fill out va you conduct make

How to fill out 8873:

Who needs 8873:

Video instructions and help with filling out and completing va you conduct make

Instructions and Help about iii unsatisfactory gi blank form

Laws dot-com legal forms guide a VA Form 22 – 1990 is the Department of Veteran Affairs form for applying for education benefits this form is used for applying for the various GI Bill educational funds reserve educational assistance program and post-vietnam era educational assistance program provided to military veterans the VA form 22 – 1990 is available on the Department of Veteran Affairs website or can be supplied by the Veteran Affairs Office near you Part 1 requires the basic veteran identification information who is applying for the education benefits you must put your name social security number address phone number and direct deposit information for your educational funds you must also provide the name and contact information for someone who will know where to contact you Part 2 asks you to identify the education benefits for which you are applying if you are unsure of which benefits you may be eligible for the VA form 22 – 1990 also comes with instructions which provide basic information on the different types of education benefits and the qualifying criteria part 3 requires that you identified the education type you plan on using the educational funds for your selection in this section must match with the type of funds you are applying for in section 2 if you are unsure of which funds to apply for check with the instructions or contact the Veteran Affairs office for assistance part 4 requires that you provide a history of your military service and all specific details pertaining to your service you must provide the dates you are active the service area your current status and your active duty history part 5 requires that you provide all of your education and non-military employment supply as much detail about your education and employment history if you need more space you can attach additional information with your VA form 22 – 1994 part 6 you must provide any additional entitlements you are receiving from your military service this can include multiple sources of entitlements such as scholarships kicker's or other forms of financial aid check with your school to ensure that you include all amounts that are in this section part 8 requires you identify your marital status and whether you are responsible for any dependents once your VA form 22 – 1990 is completed you must submit it to your regional Veterans Affairs Office which are listed on the instructions to watch more videos please make sure to visit laws dot-com

Fill you unsatisfactory omb search : Try Risk Free

People Also Ask about va you conduct make

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your va you conduct make online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.